订阅邮件推送

获取我们最新的更新

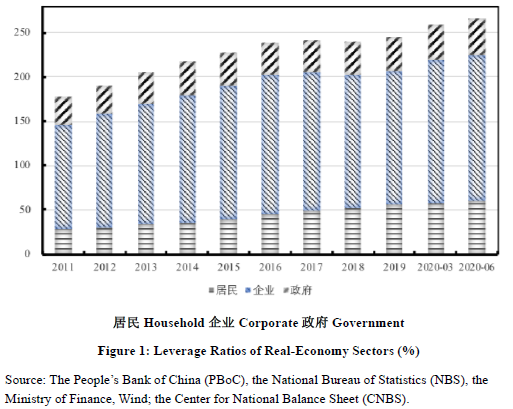

Quarterly Report on China’s Macro Leverage Ratio, Q2 2020

In Q2 2020, China’s real-economy leverage ratio increased by 7.1 percentage points to reach 266.4%, up from 259.3% at the end of Q1. Sector-wise, the household leverage ratio rose by 2.0 percentage points, up from 57.7% to reach 59.7% at the end of Q1; the non-financial corporations’ (NFCs) leverage ratio increased by 3.3 percentage points, up from 161.1% to reach 164.4% at the end of Q1; the government leverage ratio rose 1.8 percentage points, up from 40.5% to reach 42.3% at the end of Q1. Meanwhile, the M2/GDP ratio rose by 3.8 percentage points, up from 212.5% to reach 216.3% at the end of Q1; aggregate financing to the real economy/GDP ratio increased by 7.6 percentage points, up from 267.8% to reach 275.4% at the end of Q1.

In Q1 2020, China’s real-economy leverage ratio climbed by 13.9 percentage points, the second-highest since Q1 2009. In Q2 2020, the growth slowed to 7.1 percentage points, or about half that in Q1. Two factors usually drive change in the leverage ratio - debt (the numerator) and economic growth (the denominator). As far as Q2 economic performance is concerned, debt or credit expansion gathered strength without letup. Total debt of the real economy grew by 12.4% year-on-year at the end of Q2, total debt of the M2 grew by 11.1%, and total debt of aggregate financing to the real economy grew by 12.8%,, which are respectively higher than the year-on-year growth rates of total debt of the real economy of 11.1%, total debt of the M2 of 10.1% and total debt of aggregate financing to the real economy of 11.5% in Q1 2020. Therefore, it can be inferred that the slowing growth in the leverage ratio was driven by a reversal from negative to positive economic growth rates as the denominator of the leverage ratio played a bigger role. If the economy further recovers in the second half of the year, we may expect slowing growth, and even a quarterly decrease, in the macro leverage ratio.

The corporate leverage ratio contributed 70% to the 13.9 percentage points increasein China’s macro-leverage ratio in Q1 2020, while the government leverage ratio contributed 16% and the household leverage ratio contributed 14%. The increase in the corporate leverage ratio contributed 46% to the 7.1 percentage point rise in the macro-leverage ratio in Q2 2020, increase in the government leverage ratio contributed 25%, and increase in the household leverage ratio contributed 28%. Compared with Q1, the marginal contributions of the household leverage ratio and the government leverage ratio increased in Q2, improving the overall leverage structure.

......

作者相关研究

Author Related Research

- 暂无 Null

相关研究中心成果

Relate ResearchCenter Results

- 暂无 Null