订阅邮件推送

获取我们最新的更新

Enhancing Regulation on Financial Holding Companies

After the dawn of the new century, financial holding companies have experienced unprecedented development in China. The integration of new technologies and finance has spawned new forms of financial holding companies. While promoting the transformation of China’s financial structure, the development of financial holding companies has posed a challenge to China’s existing regulatory system designed for financial institutions specialized in separate sectors, and thus heightened potential financial risks. Over the past few years, China’s policymakers have been reiterating the importance to ward off systemic financial risks, so much so that they have identified the prevention of financial risks as the first of the “three tough battles” at the end of 2018, followed by reducing poverty and tackling pollution. The trend towards financial conglomerates, mainly in the form of holding companies, has increased the complexity of financial organizations and risks. However, potential financial risks stemming from financial holding companies may disrupt the financial system’s future stability, but have yet to receive great attention.

As a form of financial organization, financial holding companies evolved from bank holding companies in the United States. For a rather long period, the United States prohibited banking institutions from setting up subsidiaries across states. To skirt this legal restriction, US commercial banks established holding companies to offer banking services in other states. Since then, bank holding companies started to develop towards financial holding companies. After the Great Depression of the 1930s, the United States introduced the Glass-Steagall Act that separated commercial banking, securities, and insurance services. To get around this regulatory requirement, some financial institutions in the United States established financial holding companies under which subsidiaries were specialized in separate sectors, turning the parent companies into universal banks in effect. The development of financial holding companies has circumvented the separate banking system, and brought the US financial system back to universal banking.

As universal banking once again took hold in the United States, China established a “separate operation” financial system in the mid-1990s. Ever since its implementation, China’s separate financial regulatory system has been challenged by the practice of mixed operation represented by financial holding companies. All companies which have amassed sufficient capital desire to foray into the financial sector. As a result, all sorts of financial holding companies have sprung up in China.

The first type is pure financial holding companies, which focus on the equity management of invested financial institutions without offering specific financial services by themselves. Another type is financial institutions which offer specific services and establish wholly-owned or controlled financial subsidiaries to pursue business diversification or bypass restrictions on mixed operation. For instance, such types of financial institutions include financial leasing companies affiliated to banks and asset management subsidiaries created by commercial banks after the implementation of the New Rule on Asset Management Products , which prohibits financial institutions from providing channel services for the asset management products of other financial institutions to get around regulatory requirements on investment scope and leverage ratio limit.

The third category is financial institutions established by industrial enterprises under the separate regulatory system. While operating in industrial sectors, such enterprises hold controlling interests in relevant financial institutions. An enterprise in Beijing, for instance, has a complete array of financial institutions as its affiliates.

The fourth category is a new breed of financial holding companies emerging after the internet boom. Among them, Alibaba and Tencent are typical examples. These internet behemoths have extended their business into every facet of the financial industry, and managed to spearhead financial technology and internet finance. Such financial holding companies were established to circumvent China’s original separate regulatory system, but also represent a trend towards IT-based financial technology.

The emergence of financial holding companies has increased the diversification in China’s financial structure, and promoted the business model of financial conglomerates. Yet China’s original regulatory system was designed for financial institutions specialized in separate sectors such as banking, securities, and insurance, rather than offering universal services under the same roof. China has adopted the macro-prudential regulatory approach and relevant policy system accordingly. In its institutional reform of 2019, China has restructured its financial regulatory system based on the principle of functional regulation. However, China has yet to bring financial holding companies under regulatory oversight, and this gap will give rise to a huge regulatory vacuum. We expect that this loophole has the potential to become a major source of systemic financial risks.

As the prevention of financial risks tops the “three tough battles” against the backdrop of financial supply-side structural reforms, it becomes natural for China to set up a regulatory system for financial holding companies. While China has yet to legally prescribe the transition from separate operation to mixed operation, the promulgation of the Interim Measures on the Supervision and Management of Financial Holding Companies (Consultation Draft) (“Interim Measures”) marks the recognition of mixed operation as a trend in its institutional arrangements. This policy document is not intended to throttle mixed operation, but aims to regulate financial holding companies for the financial industry’s healthy development. Foreseeably, financial holding companies will be increasingly important institutions in China’s financial system.

1. Regulatory Principles and Mechanism

The Interim Measures identifies a unique regulatory mechanism for financial holding companies following the general principles of financial regulation.

1.1 Regulatory Principles: Macro-Prudential Management, Look-through Supervision, and Coordinated Supervision

Compared with ordinary financial institutions under the separate regulatory system, financial holding companies boast myriad affiliates operating banking, securities, insurance, asset management, financial leasing, and other financial services, with a complex equity structure. Their related transactions will increase risk contagion between financial institutions of various types. Given these traits, the Interim Measures has established three regulatory principles for financial holding companies based on the latest regulatory approach for emerging financial organizations and business models, namely macro-prudential management, look-through supervision, and coordinated supervision.

Macro-prudential management: After the sub-prime mortgage crisis of 2008, macro-prudential management gained ground among financial regulators across the world, who strived to combine macro-prudential with micro-prudential management to address the pro-cyclical issues of the financial industry. After 2013, China took steps to form a macro-prudential management framework based on macro-prudential assessment (MPA), which has been largely confined to banking institutions and yet to extend to other financial institutions. The macro-prudential approach regulates financial holding companies as holistic entities. Under this approach, regulators continuously monitor the governance structure, capital and leverage levels, related transactions, and risk exposure of financial holding companies to effectively identify, measure, and control their overall risk profiles. The implication is that macro-prudential management will extend from commercial banking to other financial sectors, which can reduce the lack of coordination under a separate regulatory system.

Look-through regulation: It is a new regulatory concept designed to address increasingly complex equity relations, financial products, and risks. Compared with ordinary financial institutions, financial holding companies established to circumvent regulation may have a more complex equity structure. With controlling stakes in different types of financial institutions, financial holding companies may also have more complex organizational structures and incentives, and transfer capital with their related parties, making their operational risks less visible. For the complexities of financial holding companies, the central bank has called for look-through regulation on the equities and funds of financial holding companies to identify actual controllers and final beneficiaries and verify their fund sources and the fund sources of invested financial institutions to prevent fraudulent capital injections between the parent company and its affiliates, i.e. “circular capital injections.” Also, the governance and risk management systems of financial holding companies and their affiliated financial institutions should be brought under regulatory oversight.

Coordinated regulation: Functional regulation represents an important direction of financial regulation as reaffirmed at the Central Financial Work Conference. In 2019, China revamped its financial regulatory system also towards this direction. However, China’s current regulatory system remains institutionally oriented. Since the subsidiaries of financial holding companies may operate in various realms, financial innovation is still likely to cause a regulatory vacuum and encourage regulatory arbitrage. Therefore, coordinated regulation is essential to increasing the efficiency of regulation on financial holding companies.

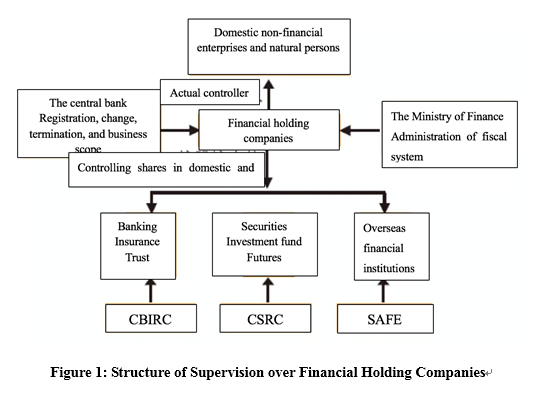

To achieve coordinated regulation, China’s financial regulators have divided their regulatory responsibilities for different types of financial institutions. Specifically, the People’s Bank of China (PBoC, China’s central bank) regulates financial holding companies, and financial regulators oversee financial institutions in which the financial holding companies own controlling interests. Specifically, the China Securities Regulatory Commission (CSRC) exercises regulatory powers over securities and investment fund companies, and China Banking and Insurance Regulatory Commission (CBIRC) exercises regulatory powers over such financial institutions as commercial banks, insurance companies, and trust companies. When a risk occurs, the financial regulator in charge of the sector becomes responsible for risk disposal. Meanwhile, regulators work closely and share information with each other to prevent risks from financial holding groups and conglomerates.

1.2 Regulatory Mechanism: Division of Responsibilities among Regulators

The regulatory system for financial holding companies divides responsibilities among regulators to ensure coordination. The implication is that regulation on financial holding companies remains institutionally oriented under the separate regulatory system, as can be manifested in the following areas:

The PBoC is responsible for regulating financial holding companies, as well as the review and approval of their creation, change, termination, and business scope. In other words, the PBoC does not have the power to directly regulate financial institutions affiliated to the financial holding companies, which is consistent with the existing legal framework and avoids putting multiple agencies in charge of regulating the same type of financial institutions. The financial regulatory reform of 2019 endowed the PBoC as the central bank with the powers of macro-prudential management, which to some extent may improve China’s macro-prudential management system.

Under existing regulatory rules, however, the central bank does not have the powers to regulate financial institutions such as commercial banks, insurance companies, and securities brokers. The assignment of regulatory powers for financial institutions affiliated to financial holding companies still took place under the original institutionally oriented regulatory system. That is to say, the CBIRC, the CSRC, and the SAFE (State Administration for Foreign Exchange) lawfully exercise regulation over financial institutions owned by financial holding companies. The institutionally oriented regulatory framework already in place, therefore, will not change as a result of enforcing regulation over financial holding companies.

Regulators should work together and share information with each other to ensure coordination. Aside from the central bank, the CBIRC, the CSRC, and the SAFE, other agencies such as the National Development and Reform Commission (NDRC), the Ministry of Finance (MOF), and the State Assets Supervision and Administration Commission (SASAC) should also share data and information about financial holding companies to develop consensus and assessment in regulating financial holding companies, take concerted actions, reduce regulatory frictions and constraints, and enhance regulatory efficiency.

2. Risk Lies at the Heart of Regulation

China continues to follow a risk-based regulatory approach for financial holding companies to promote their operational robustness and ward off financial risks. The risk-based approach is a core principle for market access, governance structure, and risk mitigation for financial holding companies.

2.1 Market Access

The establishment of a financial holding company is subject to the PBoC’s approval. Aside from the equity management of financial institutions in which they own controlling shares, financial holding companies may also offer other financial services as approved by the PBoC to extend liquidity support to their affiliated financial institutions and manage overall corporate liquidity.

2.2 Equity Structure and Governance Mechanism

First, financial holding companies must develop a straightforward and clear-cut equity structure that can be seen through, and cross-shareholding is prohibited. These requirements are intended to make it easy for regulatory authorities and market participants to identify actual controllers and final beneficiaries. To achieve this goal, there should be no more than three corporate layers - the shareholders of financial holding companies, financial holding companies, as well as financial institutions controlled by them. This regulatory requirement will avoid a multi-tiered equity structure, and ensure an efficient equity structure that can be seen through. The financial institutions in which financial holding companies own a controlling interest are not allowed to reversely hold any interest in the parent company. Cross-shareholding among them is prohibited. In this manner, circular capital injections can be prevented, so that capital is used for authentic rather than questionable purposes. The financial institutions cannot serve as major shareholders of other types of financial institutions. For instance, a securities company cannot become a major shareholder of a banking or insurance institution, so as to insulate risks between institutions of different types. One investor, related party or person acting in concert cannot act as principal shareholder at more than two financial holding companies; as controlling shareholder and actual controller, at no more than one financial holding company. This restriction aims to avoid horizontal competition or collusion in market competition.

Second, financial holding companies need to create a complete governance structure, lawfully participate in the corporate governance of institutions in which they hold a controlling interest, and refrain from abusing their substantive control to intervene in the independent operation of institutions under their control or harm the lawful rights and interests of the controlled institutions and their stakeholders. The senior management of a financial holding company may, in principle, serve as directors of the controlled institutions, but cannot serve as their senior management. No senior manager may assume positions at more than one controlled institution at the same time. These requirements aim to prevent related transactions and under-the-table dealings between controlled institutions.

2.3 Capital and Risk Management

Capital replenishment: Financial holding companies should replenish the capital of financial institutions controlled by them when a capital shortfall arises. Apart from the capital replenishment instruments issued by the controlled financial institutions, financial holding companies as qualified issuers may also issue capital replenishment instruments to inject capital into their affiliated financial institutions.

Debt-to-assets ratio: Financial holding companies should keep debt risks under strict control, both in terms of debt size and maturity structure. Financial holding companies should enhance asset-liability management, strictly manage asset mortgage and pledge, regularly conduct asset rating and dynamic evaluation, and make impairment provisions following the price accounting standards. However, regulators are yet to adopt precise indicators on the debt-to-assets ratio or leverage ratio of financial holding companies.

Comprehensive risk management: As financial risks become increasingly complex and contagious, comprehensive risk management has become an important risk management concept for financial institutions. This concept has also been introduced in the risk management of financial holding companies. After the recent regulatory reform, financial holding groups are required to put into place a comprehensive risk management system compatible with their organizational structure, business scale, and complexity at both levels of the conglomerate and controlled financial institutions.

Controlled financial institutions are required to create a comprehensive risk management system, and adopt relevant methods to identify, measure, evaluate, monitor, report, control, or mitigate risks assumed by the controlled financial institutions. This requirement, however, is a replication of existing regulatory standards in the current institutionally-oriented regulatory system, which requires financial institutions to create an organizational structure for comprehensive risk management and risk monitoring, identification, and measurement.

At the level of financial holding companies, comprehensive risk management encompasses the following elements:

(1) Risk appetite and risk limit: Financial holding companies should create a risk appetite system designed for serving the real economy, identify the level of risk tolerance in achieving their strategic goals, determine the risk management goals, tolerance levels, and limits, include risk management requirements in their business operation and management procedure and IT system, assign risk indicators and limits to the controlled financial institutions, and create a risk disposal mechanism.

(2) Conglomerate-wide risk exposure: Financial holding companies should manage conglomerate-wide risks and large risk exposure. They should create management policies and internal control systems for large risk exposure, monitor large risk exposure on a real-time basis, develop an early warning and reporting system, and adopt risk diversification measures in line with the risk limit.

(3) Conglomerate-wide credit coordination: When its affiliates extend credit to the same enterprise or conglomerate, a financial holding company should ensure internal coordination and improve conglomerate-wide credit risk control. It should take the initiative to learn about the borrower’s financing status, and create an internal information sharing and joint credit extension mechanism for borrowers with a significant outstanding balance of loans. Specifically, it should coordinate with its controlled institutions in jointly collecting and consolidating company information, identify hidden related companies and actual controllers, and jointly create an early warning system for corporate financing risks.

(4) Risk isolation: Financial holding companies should isolate risks between them and their controlled institutions and between their controlled institutions. They should isolate risks from personnel cross-appointment, business relations, information sharing, common sales teams, IT systems, operation backstage, business facilities, and business venues. Effective risk mitigation contributes to customer protection.

(5) Related transactions: Financial holding companies must ensure that their related transactions abide by laws, administrative regulations, and the rules of the PBoC, the CBIRC, and the CSRC. Such related transactions include those between holding companies and controlled financial institutions, between controlled financial institutions, and between controlled financial institutions and other affiliates. Related transactions between financial holding companies and affiliates other than the controlled financial institutions should not violate fair competition and anti-trust rules. They should not conceal the real destinations of related transactions and funds, conduct under-the-table dealings through related transactions, harm investors or customers’ rights, circumvent regulations, or engage in any other operations in violation of rules.

3. Questions to Be Further Discussed

Judging by the existing regulatory scope and measures, there is still room to improve regulation on financial holding companies.

(1) Definition of regulatory objects: The Interim Measures defines a financial holding company as a “lawful incorporated limited liability company or joint-stock company with substantive control over two or more than two financial institutions of different types that engages in equity investment management without direct involvement in commercial operating activities.” Obviously, such a definition is too narrow. There are many such entities with controlling stakes in two or more than two financial institutions of different types but also engage in commercial operating activities. For instance, some commercial banks in China have established subsidiaries, and an industrial investment enterprise may also hold controlling interests in multiple financial institutions. Under the current definition, such institutions remain outside the regulatory framework.

(2) The threshold for creating a financial holding company is too low: The Interim Measures stipulates that the paid-in registered capital for creating a financial holding company should be no less than 5 billion yuan, and “no less than 50% of the total registered capital of its controlled financial institutions.” However, Article 6 also stipulates that “a financial holding company shall be created if the financial institutions under substantive control include a commercial bank or the total assets of the financial institutions are no less than 500 billion yuan.”

Obviously, these provisions are contradictory with each other under the same regulatory framework. By the current regulatory requirements, the combined capital of financial institutions controlled by a financial holding company with a registered capital of 5 billion yuan should not exceed 10 billion yuan, but their total assets should exceed 500 billion yuan as the minimum threshold for a controlling company to be created. In other words, the overall capital adequacy ratio of the controlled financial institutions can be less than 2%, which is unfavorable to the robustness of financial institutions. This standard also runs counter to regulatory criteria on the capital adequacy ratio of banks and other financial institutions.

(3) Deviation from the requirement on the creation of a financial holding company may intensify regulatory arbitrage. Current regulations stipulate that a financial holding company should be created “if the financial institutions under substantive control include a commercial bank, the total assets of financial institutions are no less than 500 billion yuan, or the total assets of financial institutions are less than 500 billion yuan but the total assets of financial institutions excluding commercial banks are no less than 100 billion yuan, or the total assets under management are no less than 500 billion yuan.” In other words, a financial conglomerate with total assets less than 500 billion yuan is not required to establish a financial holding company even if it operates in multiple financial sectors. This loophole creates room for regulatory arbitrage that may attract capital to the lucrative financial industry.

In our view, the regulatory standards mentioned earlier may need further improvement to raise regulatory efficiency and promote China’s financial stability.

作者相关研究

Author Related Research

- 暂无 Null

相关研究中心成果

Relate ResearchCenter Results

- 暂无 Null