订阅邮件推送

获取我们最新的更新

序言

党的十八大以来,中国金融发展取得新的重大成就。社会融资规模、金融机构数量和直接融资比例显著提高。人民币国际化和金融双向开放取得新进展,外汇储备稳居世界首位。此际,我们还发起了亚投行、金砖银行,设立丝路基金,有力支持了“一带一路”的实施,促进金融服务实体经济本源回归。毋庸讳言,我国金融业在取得显著成绩的同时,金融体系也经历了一系列冲击。

2008年以来,中国金融市场持续波动发展,其间发生的诸多事件,规模之大、影响之烈可谓世之罕见。目前,中国金融体系正处于维护金融稳定和防范系统性风险的关键期。经济金融经过上一轮扩张期后,进入下行“清算”期。同时,实体经济供需失衡,金融业内部失衡,金融和实体经济循环不畅。另外,体制性原因导致一些市场行为出现异化,道德风险明显上升,而金融监管很不适应。中国金融业面临新挑战,需直面应对。

第一个挑战就是结构失衡。目前,实体经济存在严重的供需结构性失衡,循环不畅。解决这一问题,需要扎实推进供给侧结构性改革,这也是当前和今后一个时期金融为实体经济服务的一个根本任务。

第二个挑战是外延式扩张模式已至末路。过去经济快速增长,金融业可以快速上规模,可以搞外延式扩张。随着我国经济进入新常态,原来的路已至末路。质量优先,效率至上,内涵式发展成为发展的新模式。特别是在产能过剩的条件下,更要注重存量重组、增量优化、动能转换。

第三个挑战是中国金融业的发展环境已经彻底改变。金融业制度性利差明显,一度存在“坐地收钱”的强势思维。而如今这种情况已经一去不复返了,今后要突出的是以客户需求为导向、以服务创造价值,靠竞争力吃饭。

为此,我们需要重新打造适应实体经济发展的“金融链”。这可以从六个方面入手,即把发展直接融资特别是股权融资放在突出位置,加快资本市场改革,注重提高上市公司的质量;支持创业投资,发展天使投资、创业投资等风险投资;改善间接融资结构,加快实现国有大银行战略转型,发展中小型银行和民营金融机构;坚持开发性、政策性金融功能定位,加大对重点领域和薄弱环节的支持,与商业性金融联动互补、差异化发展;中小金融机构要注重本地化,扎根基层、服务当地、精耕细作,不宜搞业务多元化和跨区域经营;促进商业保险发挥长期稳健投资作用,发挥经济的“减震器”和社会“稳定器”功能。

事实上,这也是2017年全国金融工作会议为未来金融体系勾画的要点。在全国金融工作会议上,习近平总书记做出了“金融风险的源头在高杠杆”的明确判断。这就告诉我们,我国风险管理和加强监管任务,集中在去杠杆上,去杠杆是防范风险和维护稳定的必要前提。今后一个时期我国实体经济的主要风险,将集中体现为经济增长速度下滑、产能过剩、企业困难加剧和失业率上升等。与之对应,我国主要的金融风险将集中体现为杠杆率攀升、债务负担加重和不良资产增加。为此,促进实体经济发展,引导资金脱虚向实是关键。而引导资金脱虚向实,仅仅依靠从金融侧去杠杆倒逼资金流向实体经济,效果并不明显,更重要的仍是提高实体经济效率。而要提高实体经济效率,就必须要提高资产回报率在上升的行业的比重,深入推进供给侧结构性改革,实施大规模产业调整势在必行。

互联网金融和金融科技发展对引导资金脱虚向实、提高金融效率、促进金融服务实体经济、增强金融普惠性都具有重要意义。金融科技和互联网金融的长尾效应可以扩大金融服务范围,促进普惠金融发展,提高金融服务的公平性。同时,金融科技和互联网金融发展也有助于降低融资成本,提高资金流动性,优化资源配置。金融服务范围的扩大和金融效率的提高,进一步促进小微企业发展和居民消费水平提升,有力地支持了供给侧结性改革,从而提高了金融服务实体经济的力度。互联网金融自2013年迎来爆发性增长以来,监管态势也经历了由松到紧,由鼓励、促进到规范发展的转变。2017年7月,中央金融工作会议再次提出“加强互联网金融监管”,充分显示中央引导和规范金融科技与互联网金融健康发展的意志和决心。当前,政府监管与自律规范有机结合的管理体制正在逐步构建,行业整体风险下降态势明显,风险案件高发频发势头得到遏制,机构优胜劣汰加速调整,发展环境逐步净化。可以预见,随着专项整治收官和长效机制建立,我国金融科技和互联网金融发展必将实现真正腾飞。

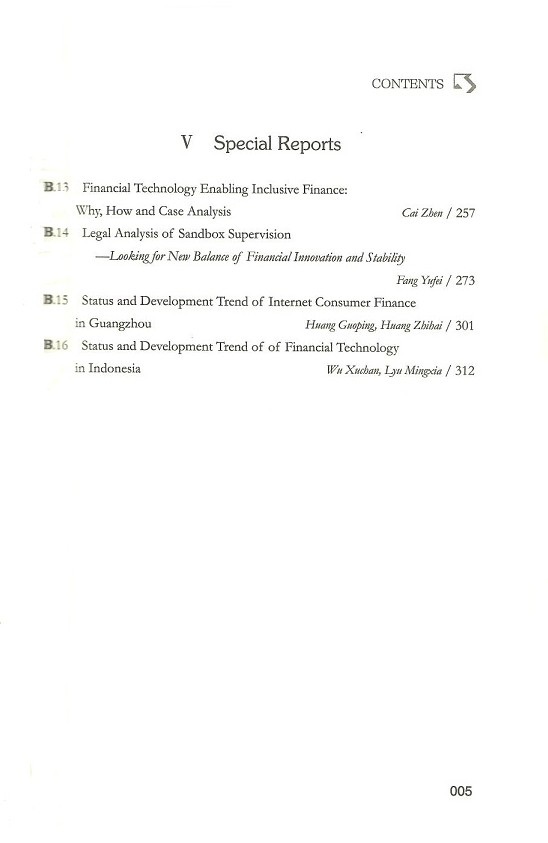

本书延续了《中国互联网金融行业分析与评估(2016~2017)》的研究框架和结构,从行业平台状况、运行态势和特征、风险管理和监管、国家监管发展与启示以及未来展望与趋势等方面对2017年以网络借贷为代表的中国金融科技和互联网金融行业总体概况进行了分析展望和总结。相信本书的出版能够为我国金融科技和互联网金融行业规范、健康发展做出积极贡献。

摘要

互联网金融自2013年迎来爆发性增长以来,监管态势也经历了由松到紧,由鼓励、促进到规范、健康发展的转变。2017年7月,中央金融工作会议再次提出“加强互联网金融监管”,充分显示中央引导和规范金融科技与互联网金融健康发展的意志和决心。目前,我国互联网金融行业正式告别“野蛮生长”的初生期,进入理性规范发展的成长期。互联网金融专项整治工作在“时间服从质量”原则下,经过严格的整顿清理亦已进入尾声。随着政策法规陆续出台,政府监管与行业自律有机结合的管理体制逐步构建,行业整体风险下降态势明显,风险案件高发、频发势头得到遏制,机构优胜劣汰加速调整,发展环境逐步净化,行业总体趋于理性。

互联网金融作为普惠金融的有效实践,支持实体经济、促进普惠金融发展不仅是互联网金融稳健发展的重要目标,也是互联网金融回归理性发展的要义和主旨。在监管与行业两相努力下,互联网金融行业的发展已经表现出由追求数量增长向追求质量提升转变。摒弃野蛮生长的毒瘤,重拾业务本源与初心成为行业发展主题。服务实体践行普惠,科技金融加速融合。从互联网金融发展的实践来看,互联网金融企业有向综合化经营与专业化经营并存的局面转化的趋势。目前,互联网金融进入门槛已显著提高,行业内部已从先前“完全市场化”的野蛮、无序竞争逐渐走向“规模化”和“垄断化”竞争趋势,涌现若干实力强劲从业机构。行业竞争愈益激烈,马太效应日渐显现。

2017年,全国金融工作会议确立了金融监管全覆盖的原则和目标。互联网金融作为传统金融的有益补充,不论是从其金融本质属性还是与传统金融紧密关系来看,纳人金融监管势在必行。当前,互联网金融行业业务转型正伏枥推进,持照经营也势在必行。网络借贷行业已经实行了实质性类似于金融牌照监管的备案登记制度;互联网保险、互联网支付则已经执行金融特许经营监管,并发放了相当数量的金融牌照;互联网众筹尽管仍处于试点过程中,但持照经营必然是大势所趋。

我国互联网金融的发展已经居于世界首位,在模式创新、技术革新方面均引领全球,不仅诞生了大量新兴的互联网金融创业企业,也产生了估值高、规模大、业务广的“独角兽”企业。在科技融合深化、商业模式成熟、竞争日趋激烈、行业回归理性的大背景下,互联网金融行业正在通过广泛的合作或依托自身平台打造丰富的生态圈体系,同时积极探索与寻找潜在的增加价值。为此,我们在监管政策和理念上,需要以促进互联网金融行业健康发展为目标,从降低成本和提升效率等多方面促进金融科技和互联网金融更好服务实体经济。同时,在监管体系建设上,着实构建中央指导、地方执行、行业自律、社会监督的跨部门跨地域的全面监管模式,在监管技术和手段上,积极拥抱“监管科技”,注重通过技术手段和分析模型的应用。

Abstract

Since the explosive growth of Internet Finance in 2013, the regulatory situation has undergone a change from loose to tight, from encouragement and promotion to standardized and healthy development. In July 2017, the Central Financial Work Conference once again put forward “strengthening internet financial supervision”, fully showing the Central Committee's mind to guide and regulate the healthy development of Financial Technology and Internet Finance. Now, China's Internet Finance industry has formally bid farewell to the initial period of “barbaric growth” and entered into the rational and standardized development period. The special rectification work of Internet Finance has also come to an end after strict inspections. With the policies and regulations promulgated, the combined management system of government regulation and industry self-regulation has been gradually established. As it is seen, the overall risk of the industry declines significantly, the frequent occurrence of risk cases tends to be curbed, and the survival of the fittest accelerates the adjustment of markets. The Internet Finance industry develops more rationally while the overall environment being purified gradually.

From the perspective of Inclusive Finance practice, to support the real economy as well as promote the Inclusive Finance development is not only an important goal for the steady development of Internet Finance, but also a gist and theme for its rational growth. With the efforts of government supervision and industry self-regulation, the development of Internet Finance has shown a change from the pursuit of quantity growth to the pursuit of quality improvement. Abandoning the tumor of barbarous growth and returning to the source of loan business become the main theme of the industry. Its development not only serves the real economy but also practices the Inclusive Finance, thus accelerating the integration of technology and finance. From the perspective of the Internet Finance development, the enterprises have the tendency to transform into the situation of the coexistence of integrated and professional management. At present, the entry threshold of Internet Finance has been significantly improved. The industry has gradually moved from the barbarous and disordered competition in a “completely marketization” state to the “large-scale” and “monopolized” competition. The market competition becomes increasingly fierce while the Matthew effect being more obvious.

In 2017, the National Conference on financial work established the principles and objectives of the full coverage of financial supervision. As a useful supplement to traditional finance, Internet finance is necessarily included in the financial regulation whether from its financial essence or relationship to traditional finance. Currently, the business transformation of Internet Finance is being promoted and the licensed operation is on the way. The network lending industry has implemented a registration system which is substantially similar to the financial licenses supervision; the Internet Insurance and Internet Payment has also already implemented the financial franchise regulation and issued a considerable number of financial licenses; the Internet Crowdfunding is still in a pilot process, but its licensed operation would be the general trend.

The development of Internet Finance in China has ranked global first, leading the world in pattern innovation and technology improvement. There has been a large number of newly emerging start-ups of Internet Finance, as well as “ unicorn” enterprises with high valuation, large scale and extensive business. Under the background of the deepening integration of science and technology, the maturation of business model, the increasingly fierce competition of markets and the returning to rational development of Internet Finance, enterprises are trying to build a rich eco-system through extensive cooperation or relying on their own platforms while exploring and seeking for potential value added. Therefore, we should make regulatory policies and rules to promote the healthy development of Internet Finance, and lead Financial Technology and Internet Finance to better serve the real economy from many aspects, such as reducing costs and improving efficiency. At the same time, in the construction of supervision system, we should construct an inter-departmental and cross-regional comprehensive supervision mode which includes the central government guidance, the really local government execution, the industry self-regulation and the social supervision. What's more, in terms of supervision means, we should actively embrace the “supervision technology” and pay attention to the application of technical tools and analysis model.