订阅邮件推送

获取我们最新的更新

摘要

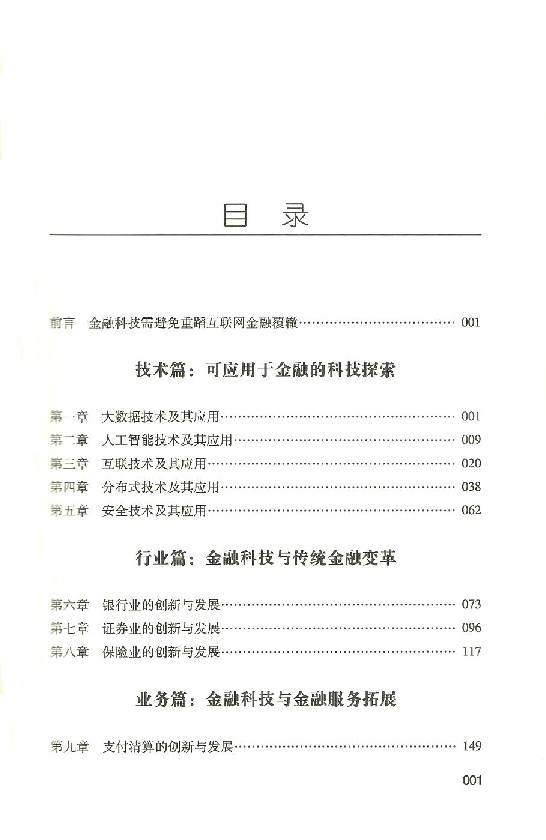

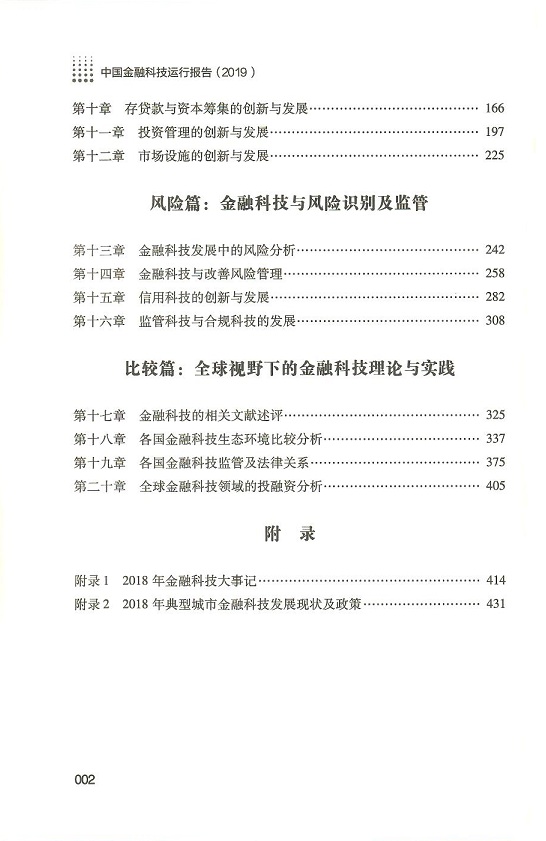

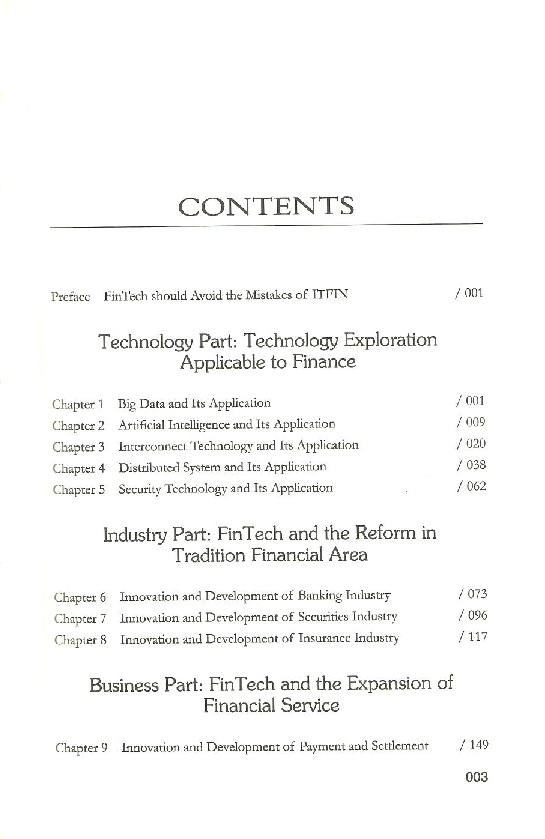

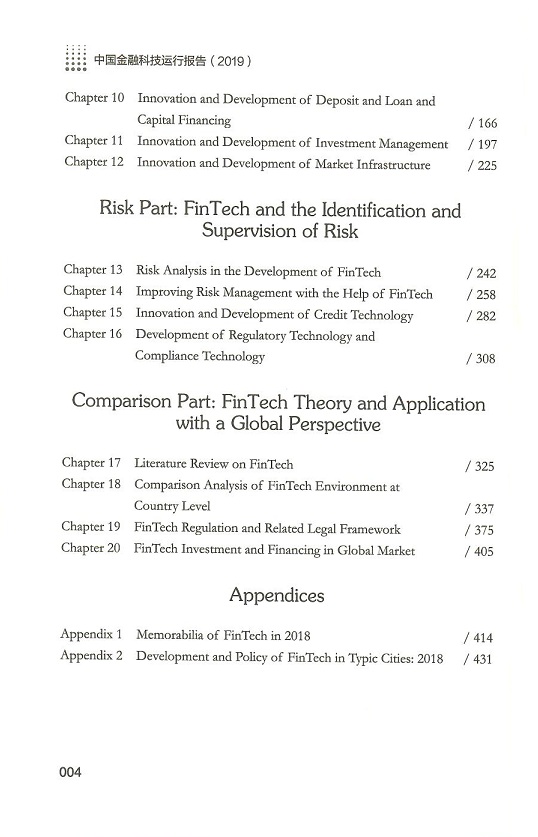

《中国金融科技运行报告(2019)》系国家金融与发展实验室金融科技研究中心与金融科技50人论坛(CFT50)联合推出的系列年度报告的第二本。报告旨在系统分析国内外金融科技创新与发展状况、演进动态与市场前景,充分把握国内外金融科技领域的制度、规则和政策变化,不断完善金融科技相关的理论基础与研究方法。

报告主要包括五个部分。一是明确了讨论“金融科技”时,究竟有哪些“科技”需要关注。围绕大数据技术、人工智能技术、互联技术(移动互联、物联网)、分布式技术(云计算、区块链)、安全技术(生物识别、加密)等,“技术篇”从基础技术及其应用层面着手,围绕相关技术类别进行了理论探讨与动态眼踪。二是虽然谈到金融科技时人们更关注新兴业态与产品,但是技术创新早已成为金融变革的主线,只是在当前形势下才趋于“质变”。由此,“行业篇”从银行业、证券业、保险业的角度深入探讨传统金融行业拥抱科技的情况及前景。三是根据金融稳定理事会和巴塞尔委员会的分类方法,金融科技活动主要分为支付结算、存贷款与资本筹集、投资管理、市场设施四类。依托该分类原则,“业务篇”侧重分析主流金融体系之外的金融科技创新尝试。四是金融科技的健康发展离不开对风险和监管的深入思考,风险识别、管理与监管本身就是金融科技研究的重要领域。“风险篇”试图在此领域弥补现有研究的不足。五是立足全球视野,“比较篇”努力探索金融科技理论、政策与实践的比较研究范式。

报告致力于为金融科技相关监管部门、自律组织及其他经济主管部门提供重要的决策参考,为金融科技企业和金融机构的业务探索提供有效支撑,为金融科技领域的研究者提供文献素材。

Abstract

China FinTech Annual Report (2019) is the second report co-published by the Research Center of Financial Technology in National Institution for Finance and Development and Fifty People Forum of Financial Technology. The report is aimed at improving the theoretical basis and research methods in FinTech with systematic analysis of the innovation and development, the evolution and market prospects, and the standard and policy changes in FinTech area at home and abroad.

The report consists of five parts. The first part clarifies the definition and scope of FinTech that we should give more focus on. The section of technology starts from basic technology and application level, including big data, artificial intelligence, interconnect technologies (mobile internet, internet of things), distributed technology (cloud computing, blockchain), as well as security technologies (biometrics, encryption), and conducts theoretical discussions and dynamically tracks on related technology categories. While people pay more attention to some emerging FinTech business and products, the second part shows that technology innovation has long been the main driving force of financial reform even though its role only gets recognized recently. The section of industry tries to investigate on the application of FinTech in traditional finance areas from the perspective of banking industry, securities industry and insurance industry. Based on the classification of Financial Stability Board and Basel Committee, the third part divides the FinTech business into four segments: payment and settlement, deposit and loan and capital financing, investment management, market facilities. Based on the classification methods stated above, this part focuses on the analysis of the financial innovations outside the mainstream of financial system. The fourth part proposes that healthy development of FinTech business depends on the deep understanding of risk and supervision, particularly the identification, management and supervision of risks. Those factors constitute to an important research area of FinTech. The section of risks tries to make up for the lack of those research area. From a global perspective, the fifth part explores a comparative research paradigm of theory, policy and practice in FinTech area.

This report can be a reference book for regulators, self-regulatory organizations and other economic authorities in their decision-making related to FinTech. It also offers basic materials to financial institutions, FinTech enterprises and researchers in FinTech area.